It doesn’t matter if you’re applying for a government, corporation, or foundation grant, a well-crafted budget will make or break your proposal.

We interviewed over a dozen grant consultants and professionals to understand what grant budgets need to pass the sniff test with funders and convince them to open up checkbooks.

In this guide, we are going to share examples of effective grant budgets and highlight advice from seasoned grant writers. We’ll cover:

- Different budget types

- Real-world budget examples

- A downloadable budget template

- Expert advice from grant administrators and funders

Let’s dive in!

Your Grant Budget Will Make or Break Your Proposal

A grant budget is one of the most important parts of your grant proposal.

A grant budget is a detailed financial plan that outlines the estimated expenses of your proposed project or program for which you’re seeking funding. If the budget isn’t carefully crafted or doesn’t fall in line with the requirements of the funder, it could cause you to lose the award.

In general, the steps to creating a grant budget, include identifying all your potential expenses, delineating between direct and indirect costs, and giving yourself some buffer for unexpected costs.

Likewise, always budget time for yourself to share the budget with your board and finance team so everyone’s on the same page, and you can make changes if need be before you get down to the wire with submission deadlines.

In many cases, funders will skip to your budget first before reading anything else in your proposal to make sure it meets their criteria, including:

- Alignment With Their Priorities. Most grants will specify what types of projects or operational expenses they are looking to fund, so your team should ensure your grant budget aligns with these priorities.

- Evidence of Need. Grant budgets must provide evidence of need to ensure the funding will be used to address urgent problems within your community. This evidence should coincide with the needs statement in the proposal.

- Feasibility and Transparency. Feasible and transparent grant budgets prove to the funder that you plan on using their monies in an appropriate and effective way.

- Sustainability. Funders want to support sustainable initiatives that will continue to thrive in the future (even after the grant funds run out). This is essential if you are applying for a program or project grant.

- Measurable Outcomes and Evaluation. You need to have measurable outcomes and a way to prove the impact of your proposed initiative. This includes a step-by-step plan that demonstrates how you will evaluate the success of your grant-funded project.

- Compliance and Accountability. Every grant has different compliance and accountability requirements, so it’s important to ensure your budget meets these specifications.

- Clear and Compelling Narrative. Knowing how to write a clear, compelling, and organized budget narrative is imperative to justifying your project’s costs that are attributed in each line item or category within the budget. This will enhance the credibility of the funding request.

For example, if your budget is too high, a funder might immediately pass you over. If your budget is too low, you could be setting yourself up for failure.

The NIH Central Resource for Grants and Funding Information, a leader in grant funding, further emphasizes the importance of properly estimating your budget:

“Significant over- or under-estimating suggests you may not understand the scope of the work.” - The NIH Central Resource for Grants and Funding Information

Even if you have the perfect idea for a new project, you will still lose out on funding if your grant budget isn’t feasible and in line with the funder’s priorities.

Santa Clara County Office of Education covers several more helpful tips for building grant proposal budgets in their webinar (starting at 3:27).

There Are Several Types of Grant Budgets You Might Use in an Application

There are several types of grant budgets you might use in a grant proposal.

Below we’ve outlined five of the most common budgets and explained when and why they might be used:

- Operating Budget: This type of budget is used for funding an organization's ongoing operational expenses, such as staff salaries, rent, utilities, and administrative costs. Operating budgets are often used for grants that support the general functioning of an organization.

- Program and Project Budgets: The most common types of grant budgets are used for specific programs or projects. For example, your nonprofit might be starting a new after-school program for disadvantaged youth and your budget would include all of the materials and supplies needed to run the program. Program and project budgets can be used to jumpstart new initiatives or support existing ones.

- Capital Budget: This type of budget is used for large-scale construction projects, purchasing new facilities, making renovations, or even purchasing new equipment. These budgets are large in size because they are used to fund capital projects that support the long-term operational needs of an organization.

- Research Budget: This type of budget is for research projects and community programs. For example, an environmental nonprofit organization may want to conduct research on pollution in their area’s streams and rivers. Their research budget could include the cost of the testing equipment, the researchers’ salaries, and more.

- Multi-Year Budget: Multi-year budgets simply refer to budgets that span over multiple years. The funder usually specifies if they are awarding a multi-year grant, which means you will need to detail in your budget how you will sustain your project, research, or initiative over a longer period of time.

Grant budgets will look different depending on what they’re for. But each budget will include direct costs, those expenses related to the project or program you’re funding, as well as indirect costs that go along with running an organization. Depending on the type of grant you win, the award will cover only direct costs, or, if a general operating grant, it may cover much more.

To make it more concrete, let's look at 3 examples of grant budgets. We'll show an operating budget, a project budget, and a capital budget.

Operating Budget for Violence Prevention and Intervention

Operating budgets are easier to develop because you can estimate the amounts based on the day-to-day costs in your organizational budget from the prior year.

Some common operational expenses could include the following:

- Salaries and benefits for staff members

- Office rent and utilities

- Administrative and office supplies

- Marketing and outreach expenses

- Accounting and legal fees

- Fundraising expenses

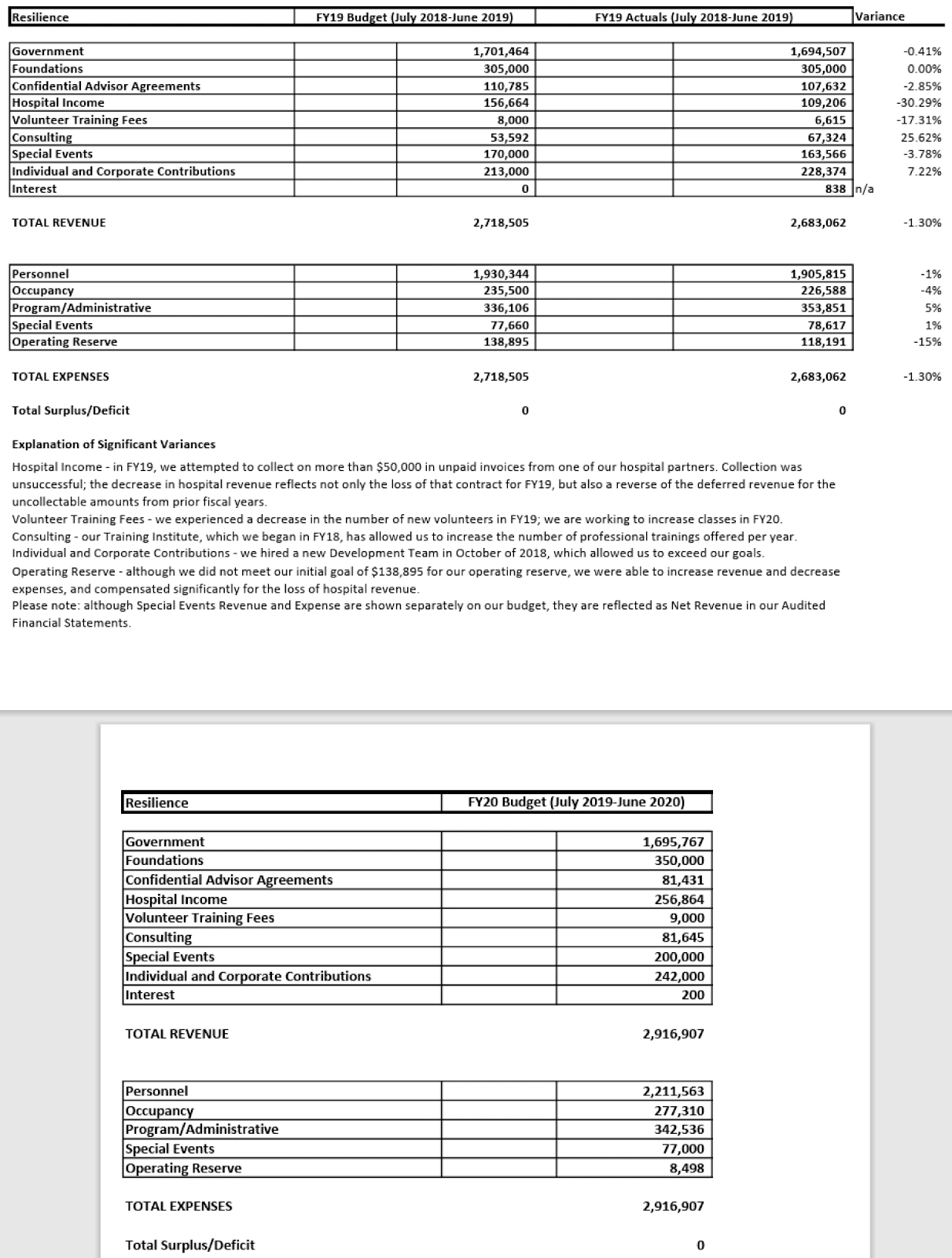

As an example, the operating budget below details the total expenses for a General Operating Grant for $40,000 for a Chicago-area violence prevention and intervention nonprofit. This example even includes explanations of variances between the budget and actual amounts:

Project Budget for a Community Education Program

Project budgets should outline your overall spending plan for your entire project, from successfully executing it to evaluating its impact and sustainability.

Line items usually found in a project plan include:

- Project coordinator's salary

- Outreach and education materials

- Training sessions and workshops

- Equipment and supplies

- Travel

- Evaluation and data analysis costs

The Council of New Jersey Grantmakers has a project budget sample for a Community Education Initiative that lays out each budgetary requirement clearly and accurately for the funder:

Capital Budget for a School Renovation Project

Capital grants are usually for large-scale items like construction, renovations, or equipment.

Budgetary items include:

- Construction and renovation costs

- Architectural and engineering fees

- Building permits and inspections

- Furniture and fixtures

- Technology infrastructure

- Contingency for unexpected construction issues

Western Kentucky University had numerous improvements they wanted to complete on their campus. They created a capital budget that detailed the capital expenditures over a multi-year life of a possible grant. The entire capital budget can be found here, and a sample of their budgetary items is shown below and can be used as a budget template:

Downloadable Grant Budget Templates

There are many resources to assist you with creating your own budget after you’ve considered all of the direct and indirect costs of your project.

For example, one of the helpful grant budget examples comes from the Substance Abuse and Mental Health Services Administration (SAMHSA). You can download this example here and repurpose it to use as your own budget template.

This sheet provides a great sample of staffing and personnel needs for a proposed project. It also walks the reader through a budget justification and includes matching grant funds.

You can also use Instrumentl's Grant Budget Template sample from the U.S. General Services Administration, which is a simple budget in Google Sheets that can be tailored to your specific budget line items.

This is another helpful example that you can repurpose with your own budgetary information.

Expert Advice on Building Your Grant Budget

There’s a lot of advice you’ll hear through the grape vine regrading grant budgets. To help pick out the signal from the noise, we interviewed several seasoned grant professionals. Here’s what they had to share.

Details Matter

All experts agree that details matter when compiling your budget. If the details aren’t clear or don’t add up, a funder will see through your numbers.

Elizabeth Morgan Burrows, JD, principal of Burrows Consulting, stresses that you should have a detailed budget that lists each of your expected expenditures for the entirety of your project. That way, the funder has a clear understanding that your nonprofit has the means and manpower to complete the proposed project.

Some general line items you will want to prioritize include:

- The people working on the project and their respective salaries being funded by the grant.

- Any technology required for the project and/or the reporting requirements.

- Costs associated with specific tasks and responsibilities.

- Revenue that comes into the nonprofit for the program.

Be Consistent With Your Narrative

Each line item in your budget should align with your overall narrative. If there is an activity explained in your narrative that requires funding, it must be a line item in your budget.

Lyndel King, Chair, Board of Overseers at Hill Museum & Manuscript Library, stresses that you need to "make sure that the item is somehow accounted for in the narrative. Everything in the budget should be able to be tied back to the project narrative.”

A clear budget will instil confidence. Anything less could arouse suspicion or doubt, costing you the award.

With that said, Sarah Lange, a grant consultant, advises grant teams not to undersell themselves either.

“Funders want to see reasonable costs, but please don’t fall prey to pressure to keep overhead low! Your program costs what it costs, and your staff deserves a living wage!”

Stay Realistic and Feasible

Earlier, we discussed the importance of staying realistic and feasible. Jacob B. Chase from Chase Consulting Solutions, agrees.

He's quick to remind his clients that a realistic budget is a winning budget. It shows that your "and organization has thoroughly considered the financial aspects of the project."

Connect the Budget to Your Goals

Finally, your budget needs to establish a clear connection between the numbers and your goals.

A funder will more than likely skip over your proposal if your budget doesn’t meet the needs of the intended audience.

CEO of Chase Consulting Solutions, Jacob B. Chase, shares,

“Demonstrate a clear connection between the budget and the project goals outlined in the proposal. Funders want to see that resources are allocated to activities that directly contribute to the project's success.”

Rachel Grusin, Project Coordinator for the Legal Aid Society of San Diego, further explains that nonprofits can't expect to slide in a line item without a clear explanation for why it belongs.

Ready To Submit Your Grant Budget?

It should be clear by now that your grant budget can make or break your chances of winning funding. The examples, insights, and expert advice in this guide should provide you with the resources you need to craft an effective and compelling budget in your next proposal.

For even more helpful advice, check out these 24 tips for stronger grant proposals.

.svg)

![3 Examples of Grant Budgets That Will Win Over Funders [With Template]](https://cdn.prod.website-files.com/60b65772307b850ced32fd47/684abc2620dc423a23f68f07_65b7fb8f00c539ddf3077395_Examples%2520of%2520great%2520grant%2520budgets.webp)